EMIS for Credit and Risk

Powering confident risk assessments through high quality data and analytics

One of the main challenges in assessing the risk of doing business with private companies in ASEAN and other world's fastest growing markets is the limited availability and reliability of data. Quite simply, if you can’t trust the accuracy of the information you have, or the validity of your sources, it's impossible to make well-founded judgements

EMIS can help you to:

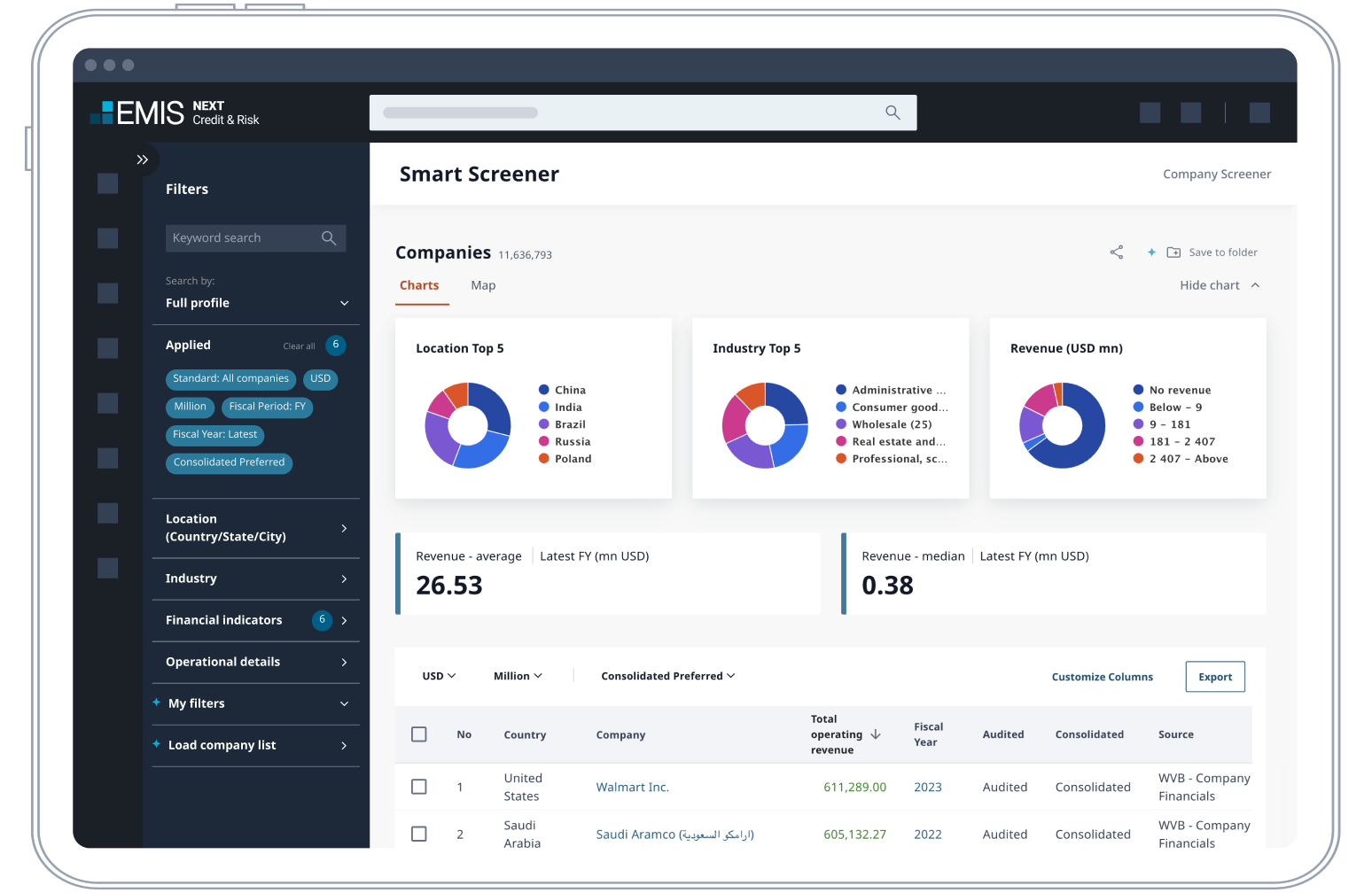

Easily manage credit portfolio

Collect accurate, up-to-date long-term financial information for companies. 🍨 Export data directly into your own templates and refresh it automatically.

Reduce risk

Conduct in-depth reviews of companies🔥 and executives as well as peer analysis.

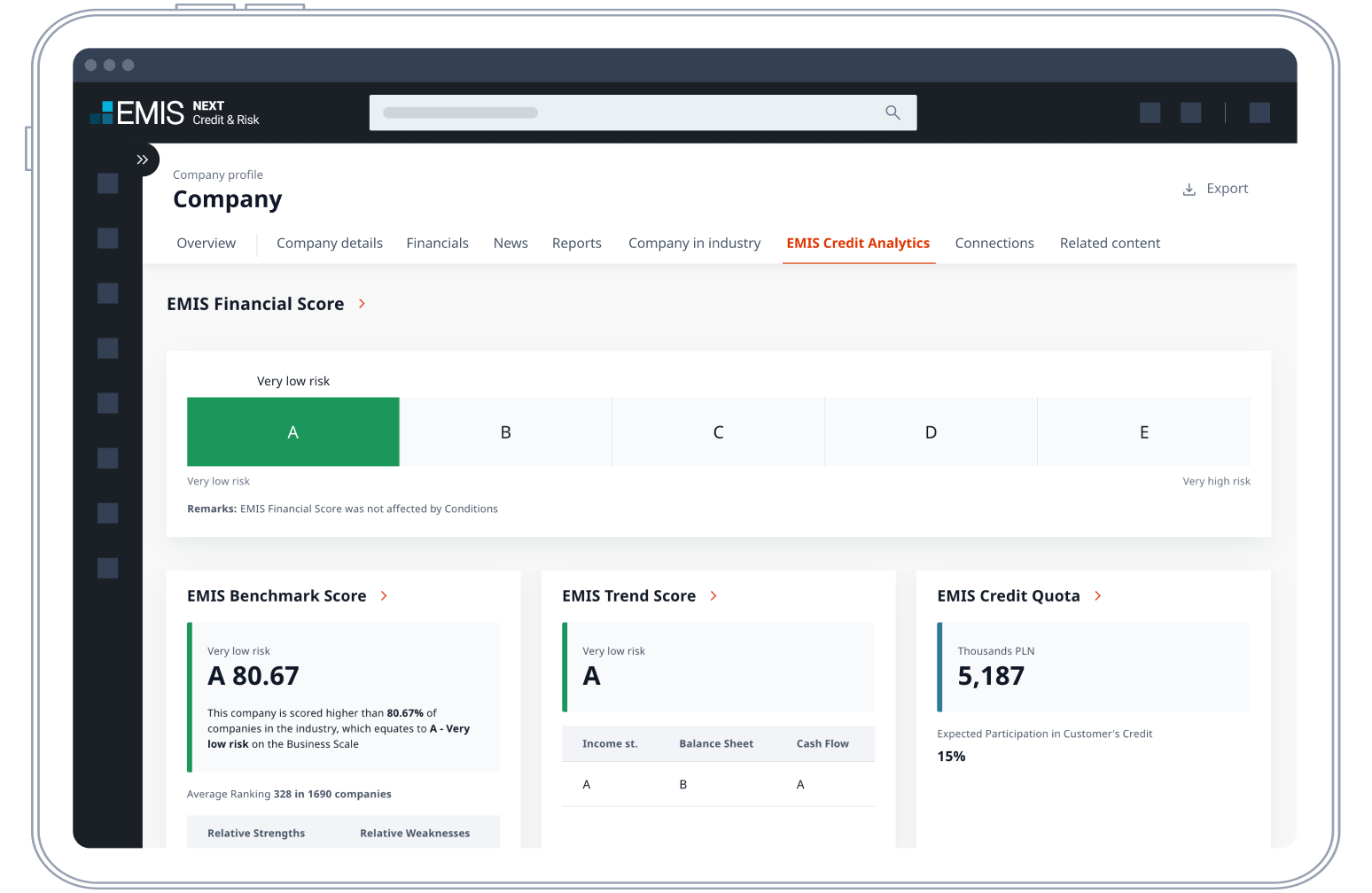

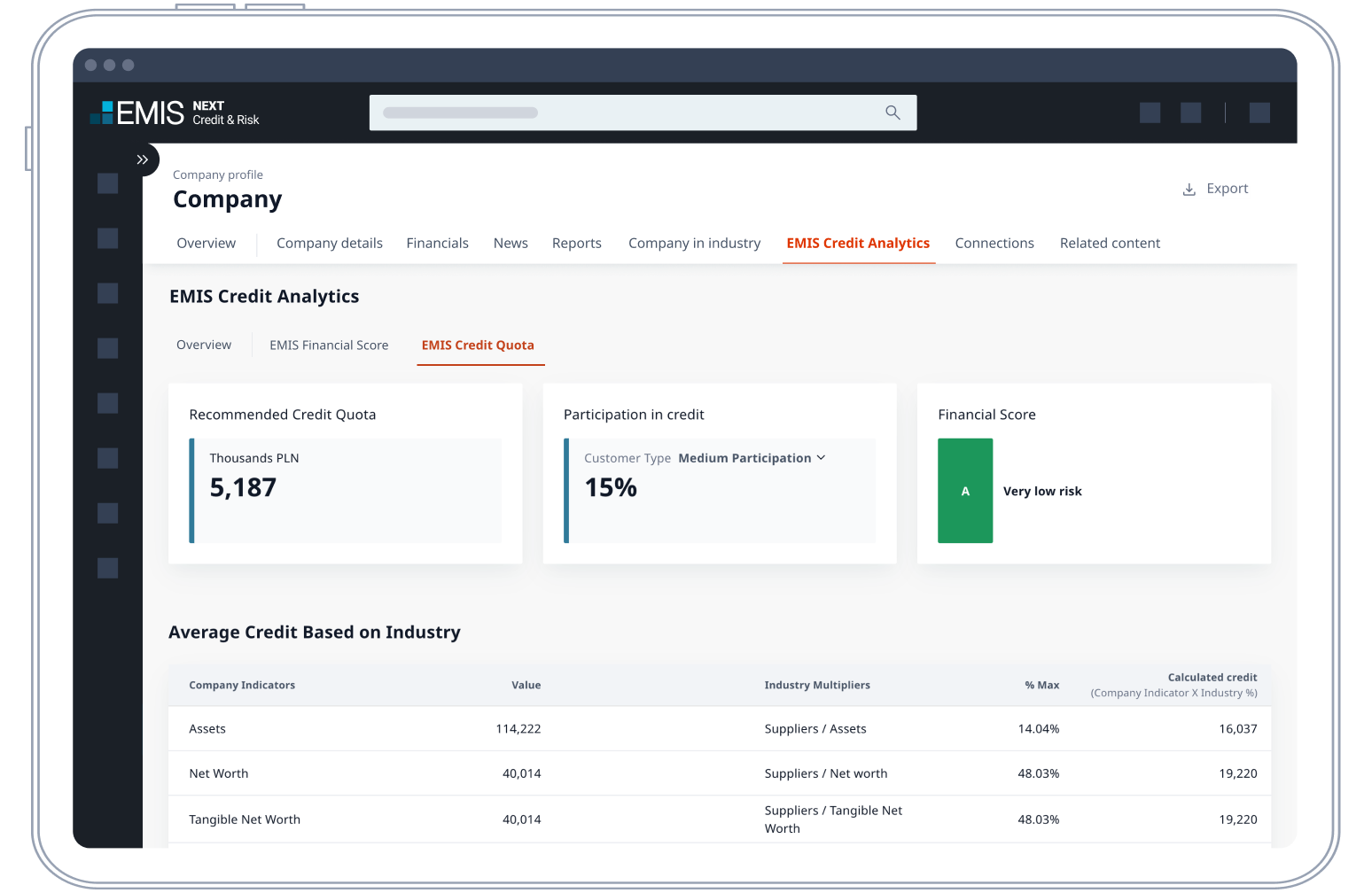

Simplify credit limits

Generate credit scores and re𒅌commendations of credit quotas customised to your own policy. Export data directly into your own templates and refresh it automatically𝔍.

Efficiently monitor your portfolio

Track and monitor companies in your portfಌolio over time with news reporting a✅nd customised alerts.

EMIS: a one-stop award-winning intelligence platform

Deep and long-term ꦓcompany financial data a❀nd news to analyse creditworthiness and risk.

Benchmarking tools to allow you to assess the relative performance of the💎 su♛bject versus peers

A customizable credit analytics model enabling scoring and recommendation of cr▨edit quotas.

ღIndustry profiles, statisℱtics and benchmarks to understand the risk within a particular sector.

Featured information sources

EMIS curates over 4,500 sources. Here are some of the top information providers that th🦩e EMIS platform 💯provides access to

Decisions supported by the best data. Learn more about our credit & risk solution.

168极速一分钟赛车视频记录:Request demo